NEW E-book: Financing your retirement—Planning ahead

Our E-book feature this month is "Financing your retirement: Planning ahead."These days money is on everyone's mind and planning ahead to finance your retirement is a hot topic. We all want to know how to make enough money and how to make it last. To do both you need to become educated about your financial options and then put a solid, yet flexible plan in place.

This 24-page financial e-book is the first of a three-part series that we will be launching this year. It is filled with tips and advice to help you plan ahead for a more financially secure retirement.

Highlights include:

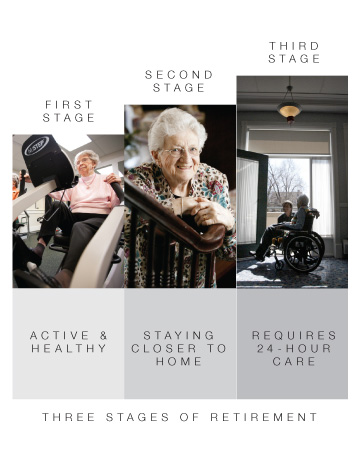

Highlights include:- the three stages of retirement and how they will impact your planning.

- how much you really need to save for retirement

- what to include in your financial assessment

- how to manage longevity risk

- when should you sell your home?

- how and when to use bridge financing

- financial advice from the pros: the top five financial questions about retirement and the top five strategies for making your money last

Innovative savings ideas for boomers

Are you a baby boomer trying to balance the financial needs of your kids with those of your elderly parents? You are probably last on your own list of priorities but you need to think of your future. We’ve got some innovative ideas to help you make extra money for retirement like renting out your driveway or tutoring a student. If you have a flexible schedule and can travel you may want to consider house-sitting—it can be an inexpensive way to take a vacation!

There are lots of ways to save for retirement; you just need to be open to possibilities. This e-book will show you quite a few options and may inspire you to think of a few more!

Download the new e-book here.

****

Related articles:

Retirement home costs

You can afford a retirement home

Canada Pension Plan changes: How will they affect you?

How to buy a retirement condo: Five experts to consult before buying

How to save money when you don't have much of it!

Five retirement savings tricks you should know